Welcome to the Sociology of Business. If you are not subscribed, join the community by subscribing below and joining the Sociology of Business Discord. You can find my book, The Business of Aspiration on Amazon and you can find me on Instagram and Twitter. For those new here, in my last analysis, The new commerce opportunity, I looked into what buyers and sellers are really looking for and how commerce destinations respond to this.

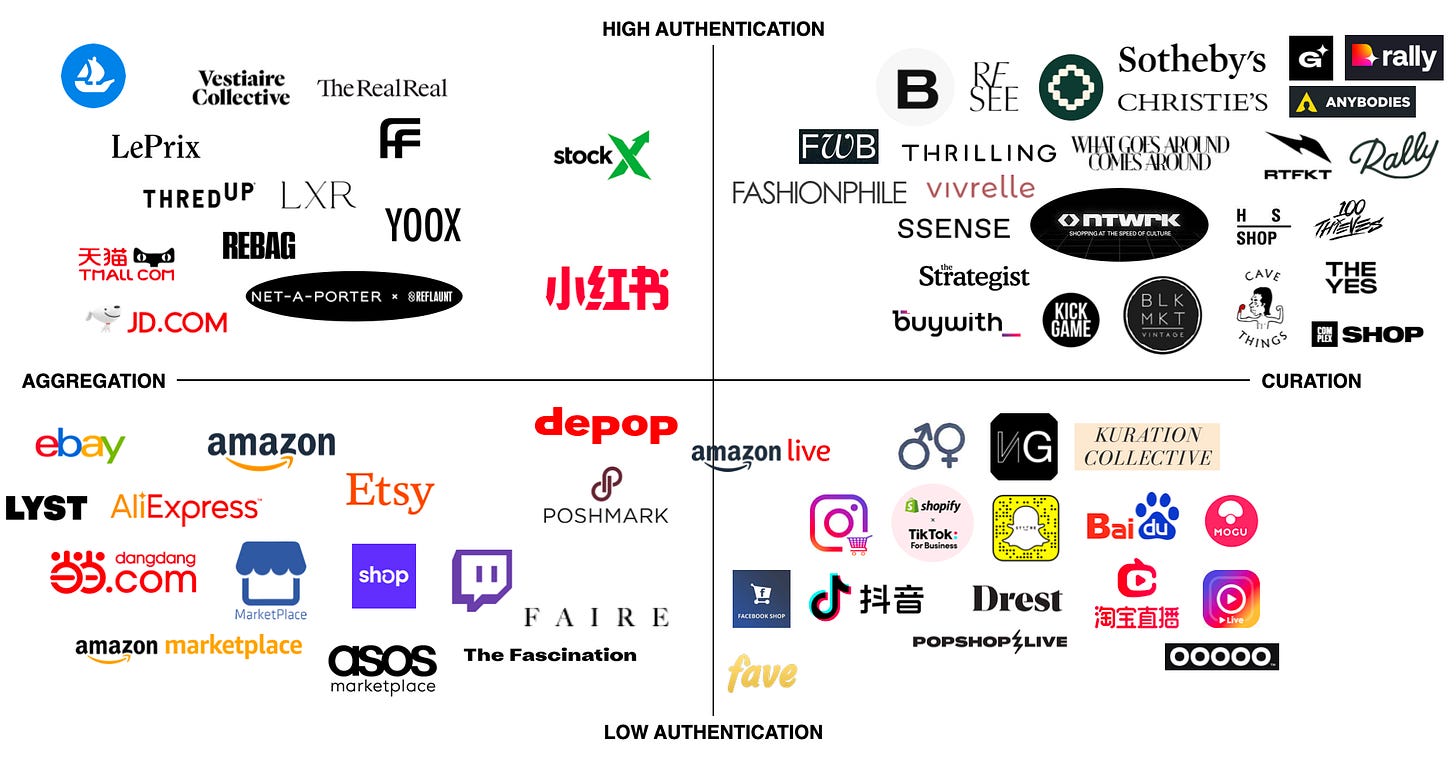

Doubling down on the exploration of the new commerce opportunity landscape, I looked into the features that power the existing and emerging commerce destinations. This space is defined by two axes. The first axis goes from an aggregate of items to the curated selection of items. At the one end is Amazon with little guidance below product reviews and on the other are sites that provide an informed point of view, like The YES, 100 Thieves, NTWRK or The Strategist. The second axis goes from low to non-existent product authentication to high product authentication. At the top of this axis are goods authenticated on blockchain and digital goods, and on the bottom goods of the unknown or generic origin.

Q1 is the area of curation and high authentication. This is the domain of traditional auction houses, like Sotheby’s and Christie’s, stand-alone retailers like SSense, curated secondary marketplaces like ReSee, What Goes Around Comes Around and Bezel, and magazine shops like Highsnobiety Shop, The Strategist and Complex Shop. There’s also a new category of sourcing and distributed ownership destinations, like Rally, as well as destinations that provide simultaneous ownership of digital and physical assets, like Anybodies, and those that connect tokens with membership benefits, like Rally.io.

References: Sotheby’s, Christie’s, Bezel, ReSee, Byronesque, Friends with Benefits, Fashionphile, Thrilling, What goes around comes around, Anybodies, Rally, Rallyrd, Genies, Highsnobiety Shop, Complex Shop, The Yes, Cave Things, The Strategist, Kick Game, BLK MKT, BuyWith, SSense, Vivrelle, NTWRK, RTFKT, 100 Thieves.

This analysis is for paid subscribers. To access, please select one of the paid subscription options.

Keep reading with a 7-day free trial

Subscribe to The Sociology of Business to keep reading this post and get 7 days of free access to the full post archives.