Welcome to the Sociology of Business. In my last analysis, Nobody knows anything, I looked into what’s next for trend forecasting. For sponsorship options, send me an email, and make sure to take advantage of 25% group subscriptions. If you are on the Substack, join the chat and I’m happy to respond to any questions in the chat or comments here.

Order my new book Hitmakers: How Brands Influence Culture, and find me on Instagram, Twitter, and Threads. With one of the paid subscription options, join Paid Membership Chat, and with the free subscription, join The General Chat on The Sociology of Business WhatsApp group.

At $4BN valuation and $750M revenue in 2023, Skims is growing fast. Now, it has a task of making its brand as innovative as the products themselves.

Drops and collabs can take any brand, even the one with an immense scaling power, only so far. They are tactics, not strategy.

Skims opportunity is grow from its current streetwear model into “Skims Inside” model, which incorporates its material technology into other brands, and the American Sportswear model, which has a long and rich cultural tradition and the modular dressing approach that can easily power Skims’ expansion.

More on all of this below, but first:

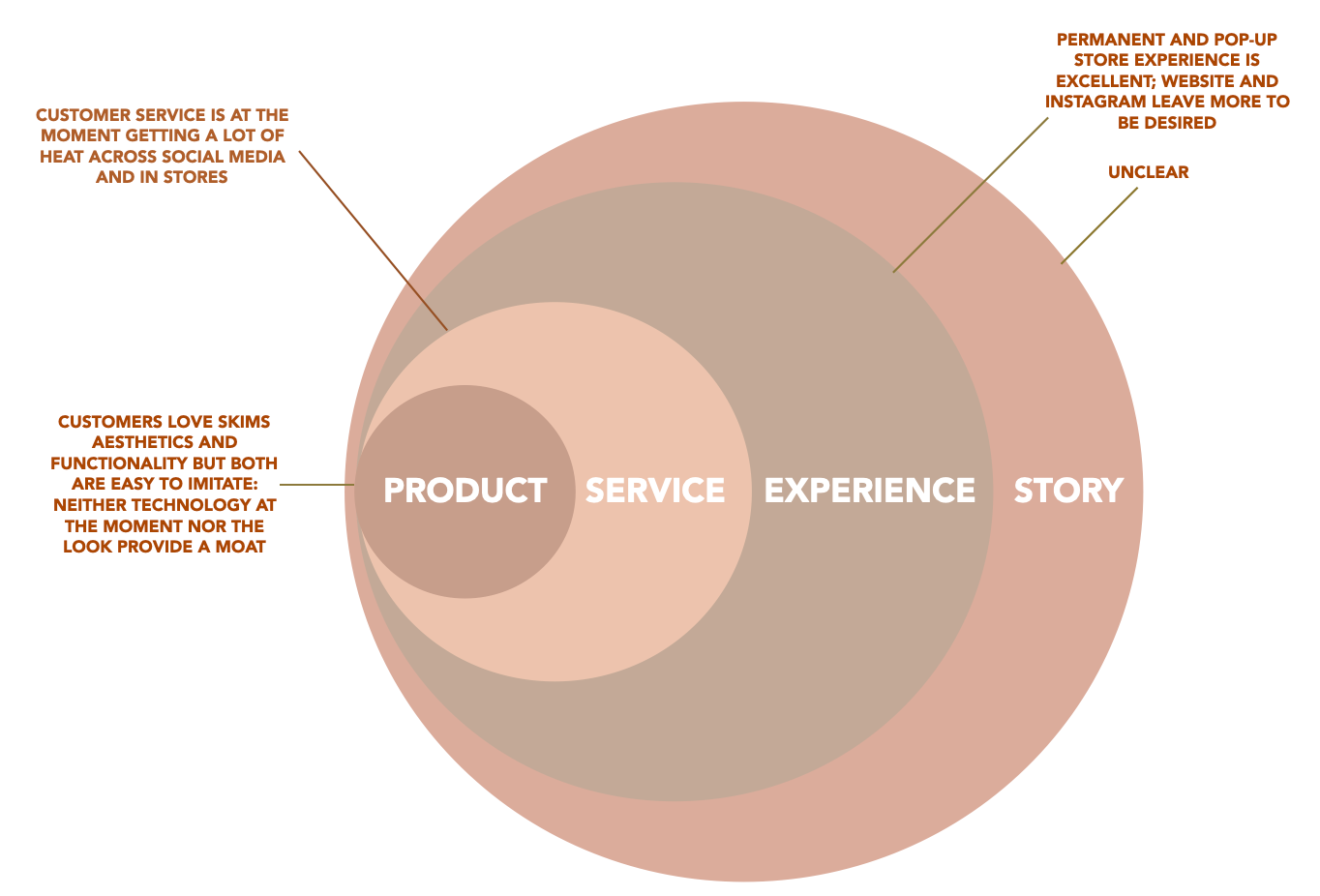

Skims’ ambition is to redefine retail, one category at the time. Despite it, the company has so far followed the traditional retail playbook: start as a pure e-commerce play, go into wholesale, and open physical stores. Well-considered, well-designed stores at high-traffic locations - the “theater of retail” - is not new (in the category, it has already been done by Victoria Secret in its heyday). What is new, for Skims, is to decide who to sell to, where to sell, and how to market across its all different channels, i.e. to define, operationalize, and manage its omnichannel retail presence.

I will be launching my book in London in conversation with Kati Chitrakorn, acting Fashion Editor of Financial Times, hosted by Lyst. RSVP at rsvp@lyst.com and hope to see you there!

Skims also talks a lot of about category reinvention, with a good reason: brands that create a new category get to became synonymous with it: Nike, Levi’s, Birkenstocks, Rolex … and achieve a lasting cultural and business power. Skims describes itself as “a solution oriented brand creating the next generation of underwear, loungewear and shape wear.” I was a little bored by the end of the sentence (is Skims going to keep adding categories at the end of this statement?). Even brands that lead with product innovation - like On Running - have a more inspiring promise.

If Skims wants “solutions” as its business growth backbone, for the long-term growth it also needs an emotional “solution,” aka clarity on the area of culture it wants to play in. Back in the day, Nike grew because it introduced a new running product, but also because it became associated with the emotion of, and around, running. Product is king, but brands with enduring power combine their innovative product with an emotion in culture. Despite the brands massive cultural presence, Skims doesn’t reflect an articulated emotion.

Skims social editorial has been hailed as the new magazine covers, but content is not a brand story. When it’s really good, content conveys a message, elicits emotion, references culture or adds to it, and it can absolutely bring a brand to life, along with everything else that a brand does (retail experience, packaging, products, brand codes, customer service, marketing activations, creative partnerships). Editorial - no matter how polished, and no matter who is in front of or behind the camera - lacking the bigger story is just a short-lived attention play. For example, Zara has excellent editorials around their collaborations and drops, but has excelled in all areas of business to become a global retail phenomenon it is today.

A side note: It is no accident that print media is a now a niche business, with most successful titles deeply steeped into a subsculture or a genre. Something similar is happening in retail, where brands now have to play across categories in order to aggregate consumer niches, held together by a tight brand universe. Emma Chamberlain’s content works well, not only because of its art direction, but because she built a brand world around her product, and each campaign showcases a different mini-galaxy of her universe, consistent in personality and the tone of voice.

OG product-led brands like Dr Martens or Levi’s or Birkenstocks have a subculture that they became first associated with (punk, hippies, German tourists) or the vibes they embodied (rebellion, exploration, crunchiness). Aesthetically and functionally, Skims is not hard to copy (Rhode ads are said to be often mistaken for Skims, and Rhode pop-ups are giving off similar Skims-store vibes, all round shapes and muted browns), so it having a cultural POV is a must-have.

In the post-mono world, the ultimate hack is niche and micro, and increasingly, the ephemeral. Fast-shifting vibes (Brat summer, Demure, Old Money, etc), “have begun to define all events, from political regime changes, to rebrands and mood shifts,” writes Róisín Lanegan in The Face.

In this context, while a mega global celebrity is a great growth accelerator, as the long-term brand strategy, it feels dated. Attention is one thing, brand-building another. Business longevity is rooted in the small, synchronized, and the consistent: a long-standing relationship with multiple generations of creators; diverse, varied, and well-defined consumer base; versatile and compelling content; and a curatorial angle (more on this below).

To hack long-term growth, a brand needs more than a celebrity person and innovative product. It needs to be able to keep hacking culture by creating a lot of cultural products and moments and connecting them into a coherent universe, supported by the strong and balanced operations that bind brand, product and business.

Product innovation that goes beyond the first-mover advantage to become the growth machine happens only when a brand becomes synonymous with a an emotion, not a market category (and featuring a celebrity du jour in campaigns ain’t it).

Despite its amazing PR and global celebrity muscle, Skims still has some work to do in how it grows and markets itself. Here are some options:

The Streetwear Model

This is the current Skims model. It revolves around the limited editions, drops, capsules and collaborations.

There is an opportunity to make this model more strategic, and zoom in on both the fashion-sport and luxury territory.

The collaborations, capsules and/or limited edition verticals can extend to tennis, fencing, soccer, running, horse racing and creative partnerships with emerging and established personalities from Enzo Lefort to Messi and Ronaldo. In this model, Skims is pop-culture: constantly reinvented, constantly remixed, constantly evolving, and constantly in motion.

The “Skims Inside” Model

In this model, Skims product technology is marketed as operating system, powering comfort and fit in the luxury and sports-fashion verticals. It taps into blurred lines between luxury fashion and sportswear on the product performance level.

Fashion has seen the trend of technical performance and fabrics innovation permeating its designs, from Louise Trotter’s work at Lacoste, Carven, and now

If you want to read the rest, including the cultural territory that Skims can easily and believably own, you’ll have to upgrade to paid. Paying subscribers: send me your questions here and I will do a compilation of selected answers.

Keep reading with a 7-day free trial

Subscribe to The Sociology of Business to keep reading this post and get 7 days of free access to the full post archives.